A Senior Debenture or Subordinated Debenture Can Best Described as

B A Company can issue convertible debentures. A A subordinated debenture has a claim that is junior to all other debt but senior to preferred stock.

Business Finance Mgt 232 Lecture 29 4 1

And in any event bondholders still have priority over all stockholders if a company goes bust.

. The main risk that comes with a subordinated debenture is the risk of default of the. A subordinated debenture is similar in character however in this case they are payed as a subordinate issue. FIN 335 Exam 3 Ch 9.

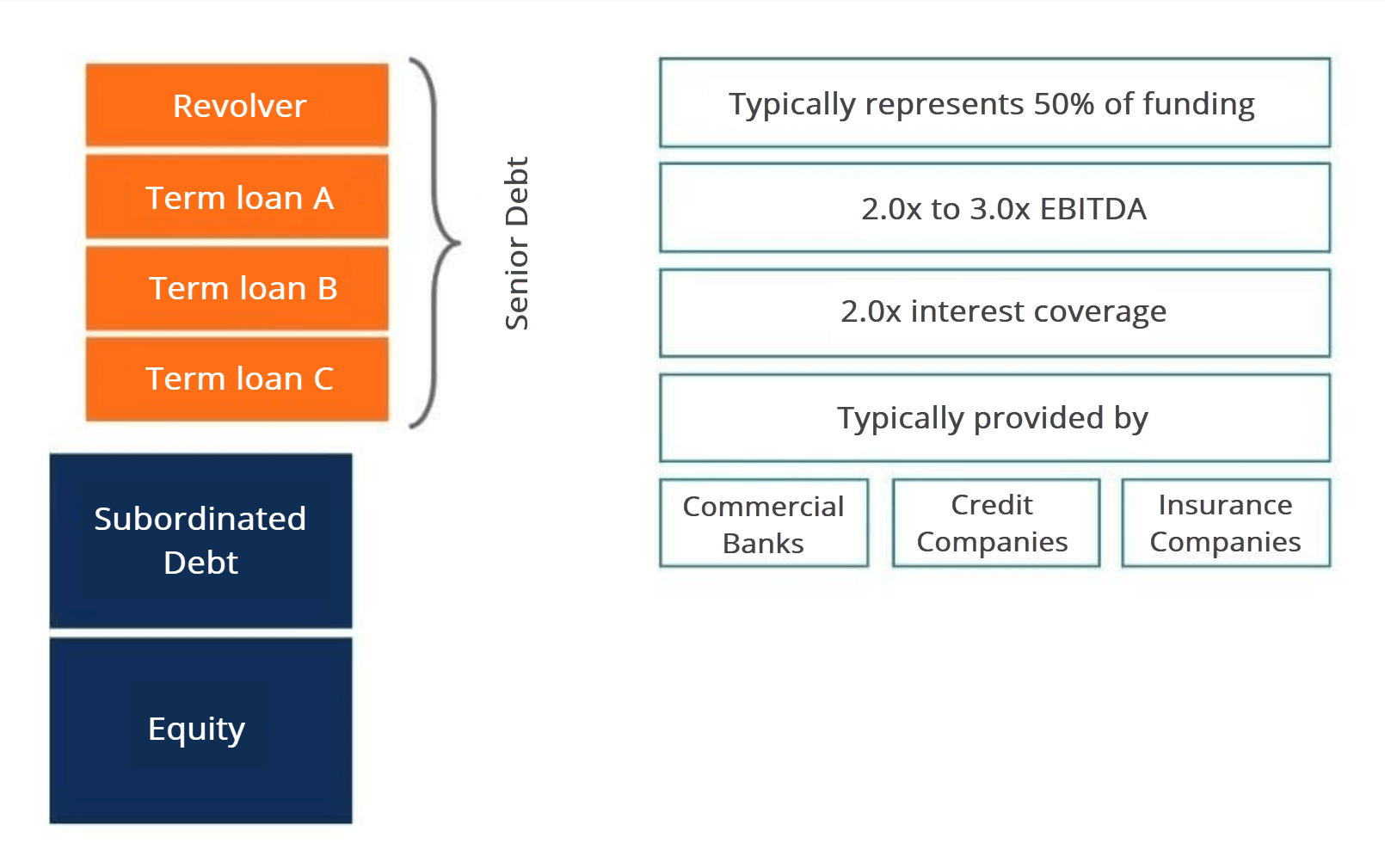

95 prediction interval is from 1 to 17. Subordinated debenture bonds are a specific type of debenture that ranks after senior debt regular debentures and sometimes even after certain general creditors. Bond means that its claim on liquidation proceeds in the event of bankruptcy is lower than other senior debentures.

As you might imagine these issues although linked to the debentures pay a higher interest rate. They are low on the list of debts to be paid and thus their issuers have to offer higher interest rates and even the option to convert to shares in some cases. 3 In the valuation process the higher the risk the greater is.

C It is common to prefix debentures with the agreed interest rate. D A debenture is a secured bond that is backed by some or all of the firms fixed assets. FIN 320 Chapter 6.

When this occurs it is recognized as the. Subordinated debentures are_____. The risk of a portfolio is best described as the.

Whenever a bond is unsecured it can be referred to as a debenture. A subordinated debenture has a claim that is junior to all other debt but senior to preferred stock. Holders of secured bonds accept a lower coupon for the security of knowing they can sell the companys assets and get paid first.

Repayment Bonds can be repaid entirely at maturity at which time the bondholder receives the stated or face value of the bond or they may be repaid in part or in entirety before maturity. A companys board of directors BOD approves a dividend payment. C Junk bonds typically provide a lower yield to maturity than investment-grade bonds.

Interest rate risk and the time to maturity have a relationship that is best described as. Interest rate risk and the time to maturity have a relationship that is best described as. It is ranked lower than senior debt in the case of default of the issuer.

Most subordinate debenture bonds pay off fine. In the event a firm goes bankrupt an investment grade senior debenture bond is more likely to receive liquida Get the answers you need now. C A subordinated debenture has a claim that is junior to all other debt issues.

It carries more risk than secured loans. Senior debenture will be paid prior to subordinated debenture. In general investors can expect senior secured debts to enjoy the highest recovery rates.

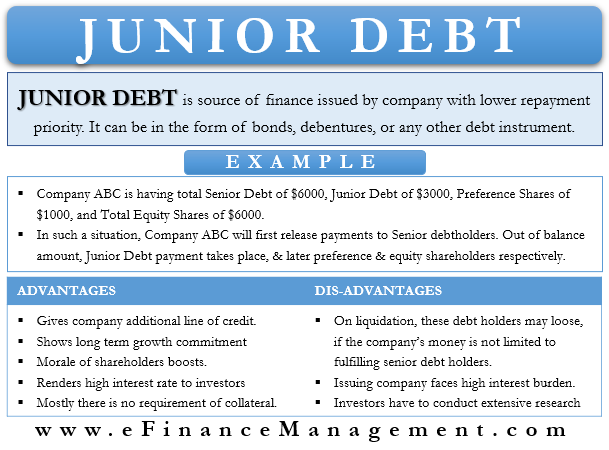

E Junior debt is debt that has been more recently issued and in bankruptcy it is paid off after senior debt because the senior debt was issued first. 2 The value of an asset depends on the historical cash flow s up to the present time. Interest is best described as.

Subordinated debt is often issued in the form of bonds. Bus 320 Exam 3 Week 122. That is an unsecured bond carries no collateral.

In the event a firm goes bankrupt an investment grade senior debenture bond is more likely to receive liquidation proceeds than. This leaves the subordinate debenture acting as a junior debt to the more senior debenture in case of insolvency. Given this information you know that the.

1 Valuation is the process that links risk and return to determine the worth of an asset. Thus the bondholder is paid out of funds that do not have. B Interest on debenture is a charge against profits.

To complicate matters this is the American definition. A debenture pays a regular interest rate or coupon rate return to investors. A A firm can buy its own debentures and shares.

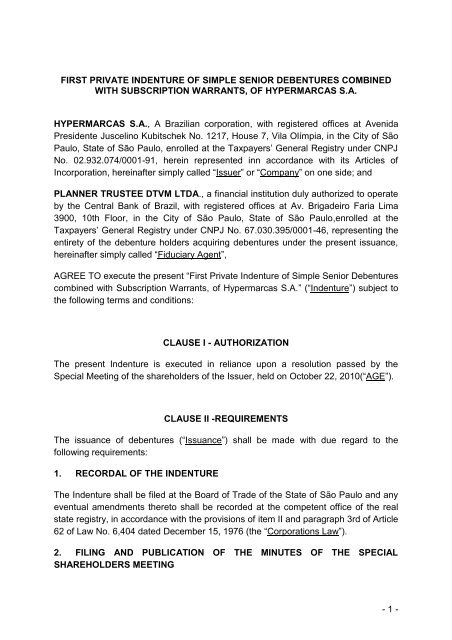

Any payment or distribution of assets of the Company of any kind or character whether in cash property or securities except that the Holders may receive securities that are subordinated at least to the same extent as the Debentures to Senior Indebtedness and any securities issued in exchange for Senior Indebtedness to which the Holders would be entitled. D A debenture is a kind of public borrowing. Convertible debentures can be converted to equity shares after a specified period making them more appealing to investors.

Unsecured Bond A debt security issued by a government or large company that is not secured by an asset or lien but rather by the all issuers assets not otherwise secured. Subordinated debt recovery rates were 31 and the junior subordinated debt recovery rate was lowest at 27. Standard deviation of expected portfolio returns.

63 A foreign bond is issued by a n ________. B A subordinated debenture has a claim that is senior to all other debt issues and equity issues. Senior debt is a companys first tier of liabilities typically secured by a lien against some type of collateral.

Senior debt is secured by a business for. Subordinated debt also known as a subordinated debenture is an unsecured loan or bond that ranks below other more senior loans. D A subordinated debenture has a claim that is senior to all.

AriawLauLafk ariawLauLafk 04062017 Business College answered In the event a firm goes bankrupt an investment grade senior debenture bond is more likely to receive liquidation proceeds than. OTHER SETS BY THIS CREATOR. In case of bankruptcy the bondholder is considered a general creditor.

Over the past 20 years the average annual return for ShortStop Baseball Gear has been 9 and the standard deviation has been 4. Point out the false statements. In a sense all debentures are bonds but not all bonds are debentures.

These are riskier and unsecured types of debts hence are offered to large corporations.

Corporate Debt Securities Ppt Download

Chris Craft Industries Inc Bond 1969 Boating Craft Industry Chris Craft Chris Craft Boats

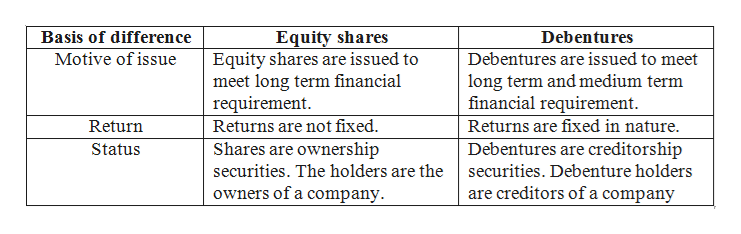

Answered State Any Three Points Of Difference Bartleby

Subordinated Debt Meaning Example Risk And More Economics Lessons Accounting And Finance Debt

Junior Debt Meaning Advantages Disadvantages And More Efm

Understanding The Difference Between Bonds And Debentures Finance Buddha Blog Enlighten Your Finances

Corporate Debt Securities Ppt Download

Understanding The Difference Between Bonds And Debentures Finance Buddha Blog Enlighten Your Finances

Debenture Bond High Resolution Stock Photography And Images Alamy

Term Loans Debentures Bonds And Securitisation Ppt Download

Senior And Subordinated Debt Learn More About The Capital Stack

Capital Structure Basics Chapter Ppt Download

What Is The Difference Between Debt And Debenture Quora

1 First Private Indenture Of Simple Senior Debentures Hypermarcas

Comments

Post a Comment